Everything about Insurance: Necessary Insights for Savvy Consumers

Insurance plays a critical role in financial security and threat monitoring. Consumers commonly overlook the nuances of different kinds of protection, causing misunderstandings and prospective voids in defense. Mistaken beliefs can cloud judgment, making it crucial to review individual requirements and options critically. Understanding these components can significantly affect monetary wellness. Yet, several remain unaware of the techniques that can enhance their insurance choices. What insights could reshape their approach?

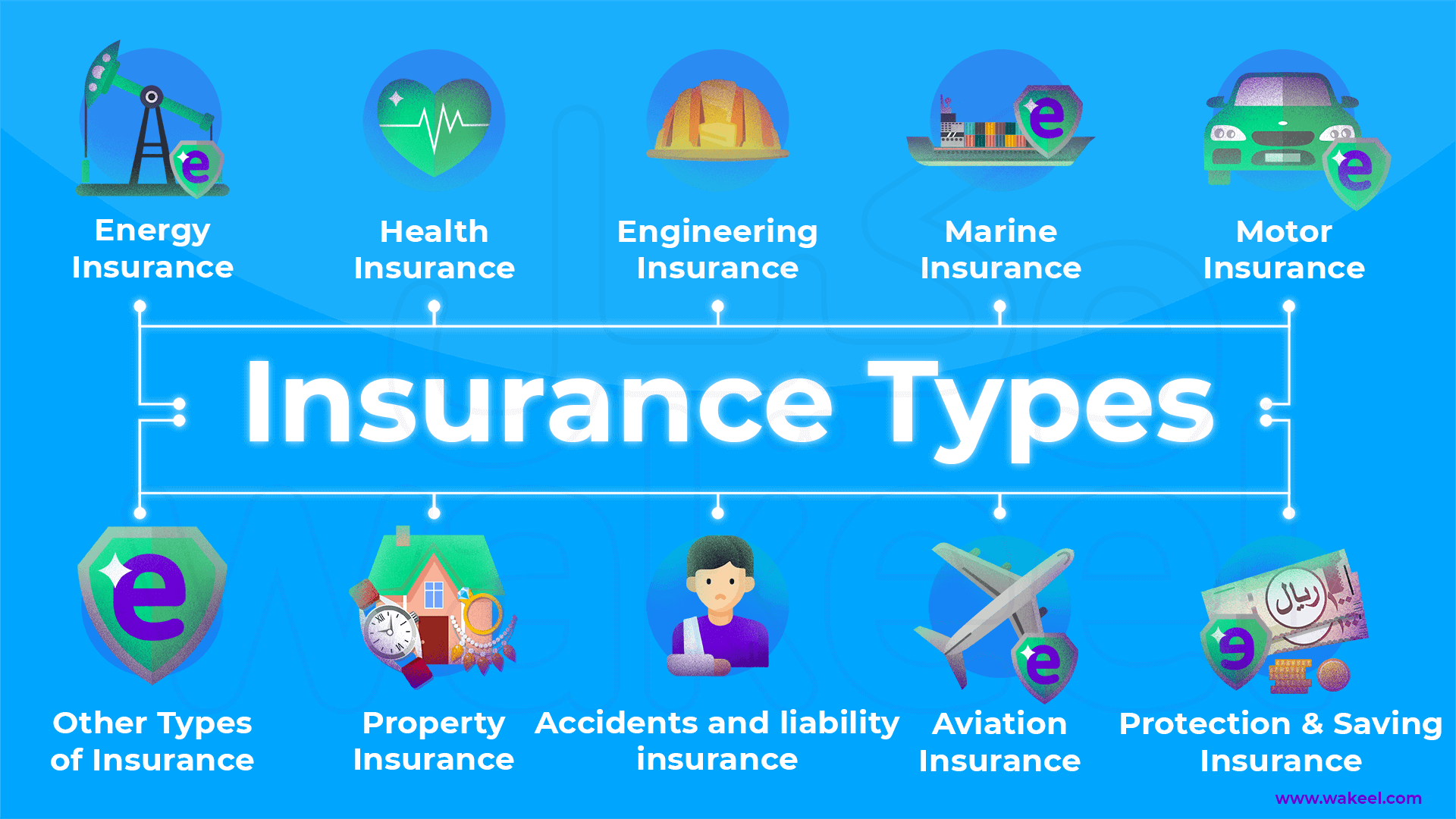

Understanding Different Kinds Of Insurance

What sorts of insurance should consumers consider to safeguard their assets and wellness? Various kinds of insurance play an essential duty in protecting individuals and their ownerships. Health insurance is necessary for covering medical expenses, making certain accessibility to necessary therapies without economic worry. House owners insurance protects versus problems to property and obligation cases, while occupants insurance provides comparable insurance coverage for tenants. Auto insurance is mandated in numerous locations and covers vehicle-related occurrences, offering monetary security in case of crashes or theft.

Life insurance acts as a financial safeguard for dependents in the occasion of an insurance policy holder's fatality, aiding safeguard their future. Disability insurance is crucial for income security during expanded disease or injury, permitting individuals to preserve a criterion of living. Umbrella insurance uses extra obligation protection beyond basic policies, offering an additional layer of defense against unpredicted conditions. Each sort of insurance addresses certain risks, making it necessary for consumers to assess their individual needs.

Typical Mistaken Beliefs About Insurance

How often do customers locate themselves misinformed about insurance? Many people harbor mistaken beliefs that can lead to inadequate decisions. A common misconception is that all insurance plan coincide, which forgets vital distinctions in coverage, exemptions, and costs. An additional typical belief is that insurance is unneeded for young, healthy people; nonetheless, unforeseen events can happen at any type of age. Additionally, some consumers think suing will instantly bring about higher premiums, which is not constantly the situation, as this varies by insurance company and private scenarios. Furthermore, numerous believe that having insurance suggests they are fully protected versus all possible risks, yet plans frequently contain restrictions and exclusions. These mistaken beliefs can cause insufficient protection or economic stress. It is necessary for customers to educate themselves about insurance to make informed options and prevent risks that originate from misinterpreting their policies.

Analyzing Your Insurance Requirements

When determining insurance requirements, consumers usually wonder where to start (independent insurance agent abilene tx). A detailed assessment starts with evaluating individual conditions, consisting of financial status, possessions, and potential responsibilities. This entails recognizing what requires security-- such as health, building, and earnings-- and recognizing the dangers related to each

Next, consumers need to consider their current coverage and any kind of gaps that might exist. Reviewing existing policies helps highlight locations that need added defense or adjustments. In Discover More addition, life modifications, such as marital relationship, home acquisitions, or parent, can considerably change insurance demands.

Involving with insurance specialists is additionally recommended, as they can offer tailored recommendations based on private scenarios. Inevitably, the objective is to develop an all-round insurance portfolio that lines up with personal objectives and uses tranquility of mind versus unpredicted events. By taking these steps, consumers can identify they are appropriately shielded without exhausting their finances.

Tips for Choosing the Right Protection

Choosing the right protection can typically feel overwhelming, yet understanding crucial factors can streamline the process. Customers need to begin by evaluating their specific needs, thinking about elements like individual properties, health standing, and lifestyle. It is necessary to research different kinds of coverage offered, such as obligation, comprehensive, or crash, making sure that each choice lines up with individual conditions.

Rate contrasts among various insurance carriers can reveal significant distinctions in costs and coverage limitations. Looking for quotes from several insurance companies can assist recognize the ideal worth. Furthermore, consumers should assess policy terms carefully, paying attention to exclusions and deductibles, as these components can influence general protection.

Consulting with an insurance policy representative can use customized insights, guaranteeing that individuals are not overlooking essential elements. Eventually, making the effort to analyze alternatives extensively brings about informed decisions, giving assurance and appropriate protection customized to one's special scenario.

The Value of Routinely Reviewing Your Policies

Routinely evaluating insurance plans is essential for preserving ample protection as individual situations and market problems transform. car insurance agent abilene tx. Life occasions such as marital relationship, the birth of a kid, or changes in employment can significantly influence coverage needs. In addition, changes out there, such as rises in premiums or new plan offerings, may provide much better choices

Customers ought to establish a timetable, preferably every year, to assess their policies. This process enables people to recognize voids in protection, validate restrictions suffice, and get rid of unnecessary policies that might no longer offer their requirements. In addition, reviewing Clicking Here policies can result in prospective savings, as consumers may uncover price cuts or reduced premiums readily available with adjustments.

Eventually, positive review of insurance plans encourages consumers to make informed choices, ensuring their protection straightens with their present lifestyle and financial scenario. This persistance not only enhances protection yet also advertises economic satisfaction.

Often Asked Questions

How Can I File a Claim With My Insurance copyright?

To submit a claim with an insurance provider, one generally needs to call the company directly, give needed documents, and comply with the certain treatments detailed in their policy. Timeliness and accuracy are important for effective claims handling.

What Elements Influence My Insurance Premiums?

Numerous variables affect insurance premiums, including the insured person's age, health status, location, sort of insurance coverage, declares history, and credit history. Insurance providers evaluate these components to identify danger degrees and appropriate premium prices.

Can I Modification My Insurance Coverage Mid-Policy Term?

Changing protection mid-policy term is generally feasible - insurance agency in abilene tx. Insurance firms commonly permit changes, impacting premiums accordingly. Policyholders need to consult their insurance supplier to understand specific terms, ramifications, and prospective expenses connected with modifying their coverage throughout the plan duration

What Should I Do if My Claim Is Rejected?

Exist Price Cuts for Packing Numerous Insurance Coverage?

Numerous insurance providers supply discounts for bundling her explanation several plans, such as home and auto insurance. This practice can lead to substantial savings, encouraging customers to combine insurance coverage with a solitary insurance company for comfort and price.